capital gains tax canada inheritance

Sometimes a capital loss will arise if you incur a loss on the sale of an asset. If the home was valued at 200000 when the decedent passed and an heir sold it for 210000 theyd only pay capital gains tax on 50 of the 10000 profit or on 5000.

For example if you buy a rare sapphire and diamond ring for 50000 and later sell it for 75000 youve made a 25000 capital gain 75000-50000.

. The estate will have to pay any capital gains taxes owed. When their final tax return is prepared the estate. Capital gains tax is not at the end of the day a distinct tax category.

Report a problem or mistake on. Capital gains tax arises when you incur a profit on the sale of an asset. Shares funds and other units.

But this doesnt mean your inheritance is immune from taxation. In Canada there is no inheritance tax. Canada said goodbye to its inheritance tax in 1972.

Instead of the tax many countries impose capital gains tax on the assets sale or ownership transfer in case of the death of the owner. However if you decide on selling an inherited house in Canada you will have to pay the capital gains tax. Guide T4011 Preparing Returns for Deceased Persons.

Find out more about final returns inheriting property and more. You dont have to pay taxes on money you inherit and you dont have to report it as income. When you inherited it it had a value of 125000.

Estate homes are considered to be sold at the current market value at the time of. Do You Pay Capital Gains On Inherited Property Canada. Your capital gains are included at 50 of the gain into your personal income so the math for increasing taxation on capital gains would have to be different to have the intended effect.

A disposition is when a living individual disposes of. Its not taxable if an inheritance passes down a primary residence. To be eligible you need.

If you choose not to or cannot pay this the value will be taken from the deceaseds estate. Canada has neither an inheritance tax nor an estate tax. That means youll theoretically owe capital gains tax on the difference between the value of the inherited home and the FMV of the home when.

Upon the sale of an inherited property you are responsible for 50 of the capital gain tax. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. Given the state-specific nature of inheritance taxes this subject is beyond the scope of this article.

Thus a primary residence sale doesnt result in taxable gains. Any real estate or property appreciates over the years. Does Canada have an inheritance tax.

There is no gift tax in Canada so living inheritances are not taxed. In 2021 this amount is 892218 and can go a long way towards reducing tax owing on any capital accumulation on investments and properties. Thats called the capital gains tax.

While there is no inheritance tax in Canada the deceaseds estate must pay taxes as a deemed disposition. Deemed disposition is the term explaining this value- Fair market value-that property would be considered to have been sold at the time of the death. There is no inheritance tax in Canada but the estate will still need to pay taxes that the deceased owes.

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. In many countries inheritance tax is collected from the beneficiaries of the estate of a deceased person. Whenever a primary residence passes through inheritance its sale is considered a primary residence sale and thus no capital gains are realized.

Capital gains taxes. Capital gains arising from the sale of inherited assets will have to be taxed at 50. That means the fair market value of the home at death gets used to calculate capital gains tax rather than the amount the decedent originally bought the home for.

Any resulting capital gains are 50 taxable and added to all other income of the deceased on their final return where income tax. The capital gains tax applies to secondary residence. The remainder passes tax free.

When this financial investment is eventually transferred to a beneficiary it would not be subject to tax. The capital gains inclusion rate for 2021 was ½ thus only 50 of capital gain was taxable. Therefore the LCGE allows you to exempt a certain amount of these gains from taxation.

Applying for probate submitting the final tax return and. To have been a resident of Canada for at least part of 2021. First of all there is no tax on capital gains of a principal residence.

In Canada all taxpayers are subject to capital gains taxes when they dispose of property. Estate taxes These are taxes paid out of the estate the government will levy taxes on 1. The capital gains tax rate in Ontario for the highest income bracket is 2676.

The second exemption is called the Lifetime Capital Gains Exemption. Capital gains tax in Canada on inheritance. To have been a resident of Canada throughout 2020 or 2022.

Any capital gains are 50 taxable and added to the deceased persons other income. There is a tax on. This means that you would owe capital gains taxes on the 75000 increase in capital.

Had this home been a primary residence you would only owe tax on 50 of the capital gain. Some countries such as Australia Israel New Zealand and Russia no longer impose this tax. Guide T4037 Capital Gains.

If a deceased person has invested in stocks valued at 100000 at the time of death and the adjusted cost base of the investment is calculated as 80000 then a capital gains tax would apply to 50 of the 20000 gain 100000 80000. We discuss this inheritance tax exemption below. It is possible that the grantor will pay capital gains tax on the disposition of the assets though.

As there is no inheritance tax in Canada all income earned by the deceased is taxed on a final return. In Canada capital gains are treated as a kind of income and like all income theyre taxable. There are no federal inheritance taxes and only six states levy any form of inheritance tax.

Line 12700 - Taxable capital gains. Instead the Canada Revenue Agency CRA treats the transferring of the estate as a sale in most cases and when someone dies their estate pays income tax for the year up until their death. The deceased will not have to pay capital gains tax on the unrealized gain of 1000.

Non-registered capital assets are considered to have been sold for fair market value immediately prior to death.

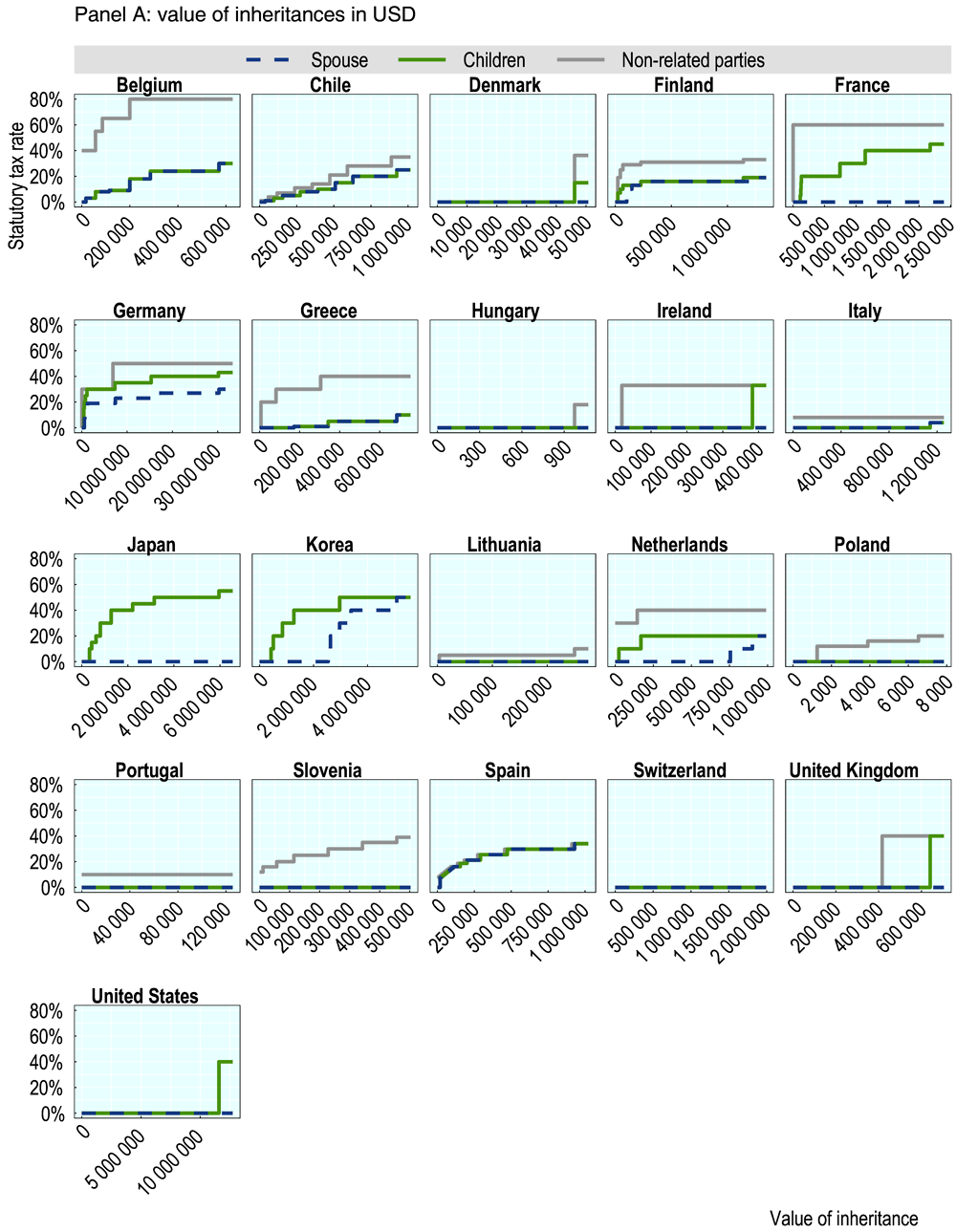

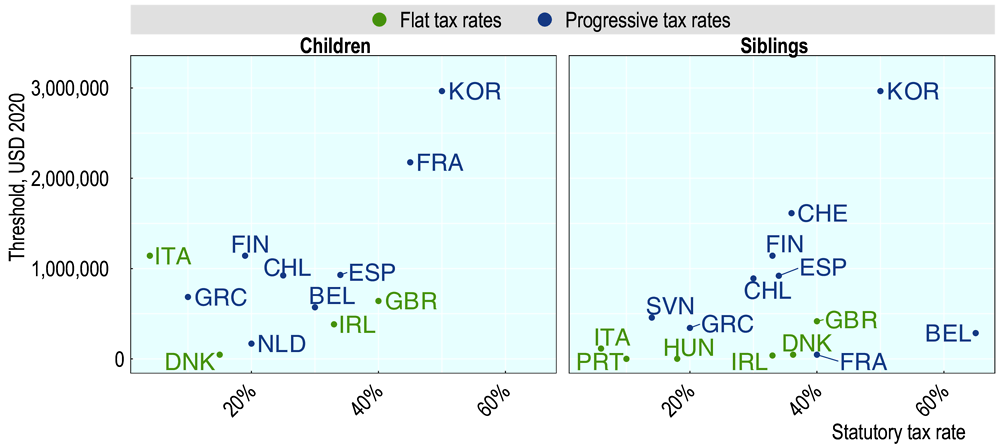

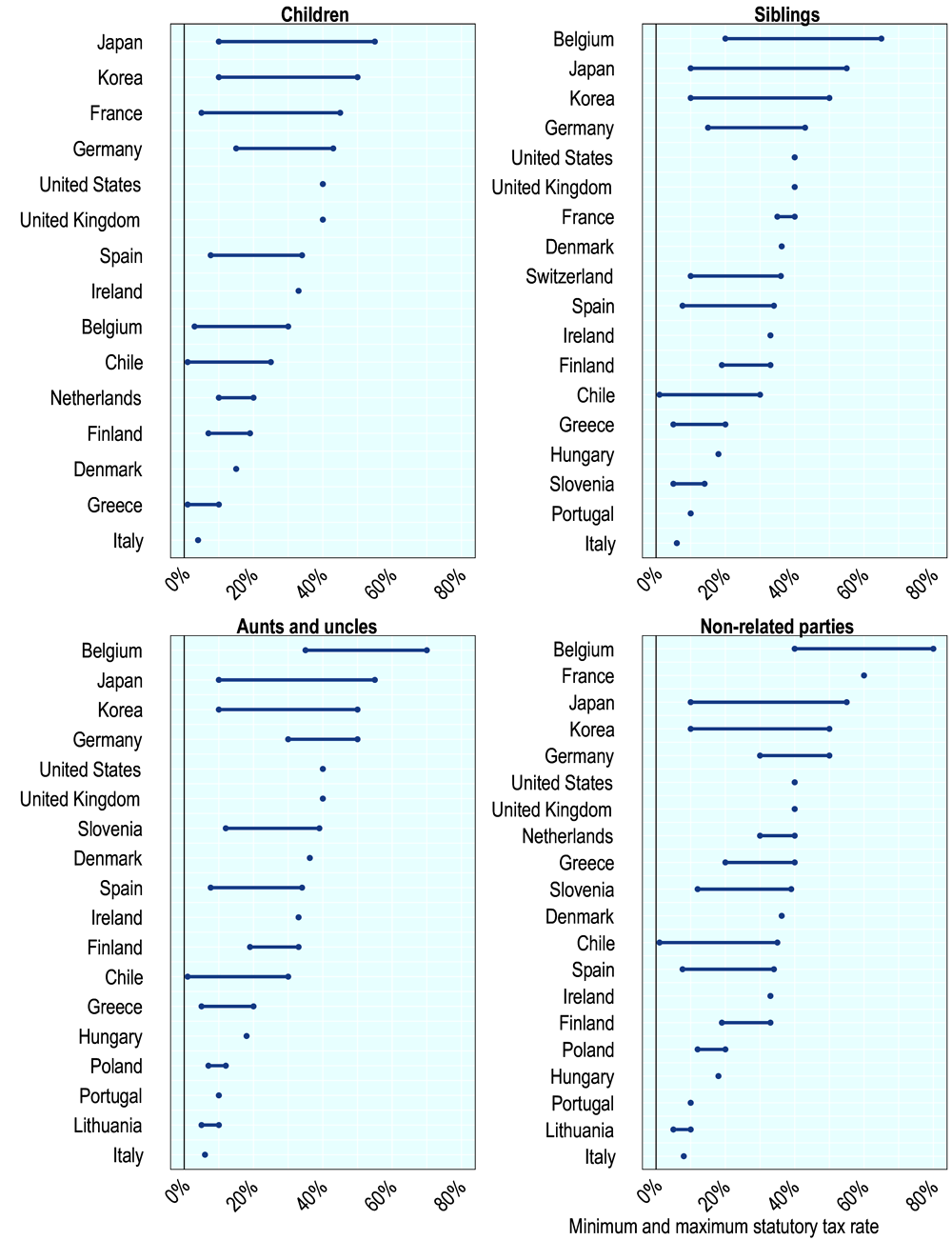

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Brochure Inheritance Taxation In Oecd Countries By Oecd Issuu

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

Chart Inherited Wealth Concentrates Among The Ultra Rich Statista

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

What Is Estate Tax And Inheritance Tax In Canada

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How Canadian Inheritance Tax Laws Work Wowa Ca

Tax Implications For Foreign Nationals Buying Property In The U S New York Casas

Is There Capital Gains Tax On Inherited Property In Canada Ictsd Org

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary