oklahoma auto sales tax rate

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. This means all new vehicle purchases are taxed at a flat combined rate of 45.

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

2000 on the 1st 150000 of value 325 of the remainder.

. Grady County collects a 075 local sales tax less than the 2 max local sales. 325 of the purchase price or taxable value if different Used Vehicle. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax.

The Hugo Oklahoma sales tax is 1000 consisting of 450 Oklahoma state sales tax and 550 Hugo local sales taxesThe local sales tax consists of a 200 county sales tax and a 350 city sales tax. This method is only as exact as the purchase price of the vehicle. The cost for the first 1500 dollars is a flat 20 dollar fee.

Hugo collects a 55 local sales tax the maximum local sales tax allowed. In Oklahoma localities are allowed to collect local sales taxes of up to 200in addition to the Oklahoma state sales tax. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes.

The Hugo Sales Tax is collected by the merchant on all qualifying sales made within Hugo. There is also an annual registration fee of 26 to 96 depending on the age of the vehicle. The 95 sales tax rate in Talihina consists of 45 Oklahoma state sales tax 2 Le Flore County sales tax and 3 Talihina tax.

You can print a 95 sales tax table here. For tax rates in other cities see Oklahoma sales taxes by city and county. This is only an estimate.

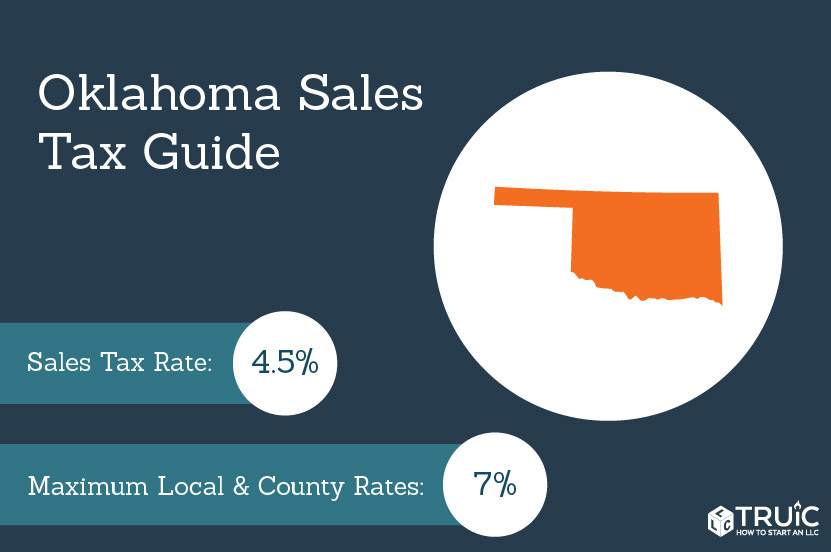

Did South Dakota v. The Oklahoma sales tax rate is currently. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax.

596 rows Oklahoma Sales Tax. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. Lower sales tax than 53 of Oklahoma localities 2 lower than the maximum sales tax in OK.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. 325 of ½ the actual purchase pricecurrent value. Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125 percent sales tax.

In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle purchases. With local taxes the total sales tax. 325 of 65 of ½ the actual purchase pricecurrent value.

The County sales tax rate is. This is also in addition to the State Tax Rate of 45. CONSUMER When the seller charges use tax on products when they are purchased by the consumer.

Excise tax on boats and outboard motors is based on the manufacturers original retail selling price of the unit. VENDOR You can pay use tax at oktaptaxokgov. 31 rows The state sales tax rate in Oklahoma is 4500.

The Yukon sales tax rate is. The Grady County Sales Tax is collected by the merchant on all qualifying sales made within Grady County. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

Rates Effective January through March 2022. The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change. Your exact excise tax can only be calculated at a Tag Office.

The Grady County Oklahoma sales tax is 525 consisting of 450 Oklahoma state sales tax and 075 Grady County local sales taxesThe local sales tax consists of a 075 county sales tax. Wayfair Inc affect Oklahoma. 325 of taxable value which decreases by 35 annually.

Sales or use tax on tangible personal property they bring in from out of state to use or consume. 5513 Luther 3 to 4 Sales and Use Increase October 1 2021 0114 Stillwell 35 to 375 Sales and Use Increase October 1 2021 3388 Jackson County 0625 to 1125 Sales and Use Increase October 1 2021 5988 Pawnee County 2 to 125 Sales and Use Decrease October 1 2021. COPO LOCATION RATE CHANGE TAX TYPE TYPE OF CHANGE EFFECTIVE DATE 0703 ACHILLE 3 6201 ADA 4 4903 ADAIR 4 3403 ADDINGTON 2 5803 AFTON 350 4103 AGRA 4 6104 ALDERSON 2 2603 ALEX.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

If the purchased price falls within 20 of the. Denotes a county tax is also due for sales in this city. Oklahoma has state.

The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name. New and used all-terrain vehicles utility vehicles and off road motorcycles. The minimum combined 2022 sales tax rate for Yukon Oklahoma is.

There is no applicable special tax. This is the total of state county and city sales tax rates. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

Use tax can also be noted and paid on the Oklahoma 511 income tax form. Average Sales Tax With Local.

Dodge Ram 1500 2500 3500 Reset Oil Light Dodge Ram 1500 Chrysler Jeep Regular Cab

Local Tax Information City Of Enid Oklahoma

Youtube The Daily Beast Turn Ons Tulsa

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Sales Tax Small Business Guide Truic

Check Availability For This Cabin Wright On The Creek Sleeps Up To 6 Nightly Rates 275 00 A Night On Weekends Broken Bow Cabins Luxury Cabin Rental Broken Bow

Oklahoma Vehicle Sales Tax Fees Find The Best Car Price

Oklahoma Vehicle Sales Tax Fees Find The Best Car Price

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

What Irs Code 280e Means For Oklahoma Medical Cannabis Business Owners Garrett Law Oklahoma

5 Things To Know Changes To Oklahoma License Plate Laws Go Into Effect Monday Local News Mcalesternews Com

Lawmakers Ok 1 25 Sales Tax On Cars

Who Has The Cheapest Car Insurance Quotes In Oklahoma 2022 Valuepenguin

Pin By Ernst Heiliger On Vintage Cars Trucks Vintage Gas Pumps Old Gas Pumps Gas Pumps

State And Local Tax Distribution Oklahoma Policy Institute

Oklahoma Estate Tax Everything You Need To Know Smartasset

Total Sales Tax Per Dollar By City Oklahoma Watch

What S The Car Sales Tax In Each State Find The Best Car Price